Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrantýx |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

o |

o |

|

Preliminary Proxy Statement |

o |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x |

ý |

|

Definitive Proxy Statement |

o |

o |

|

Definitive Additional Materials |

o | o | | Soliciting Material Pursuant tounder §240.14a-12

|

| | | | |

|

|

DUKE ENERGY CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | |

Payment of Filing Fee (Check the appropriate box): |

ýx |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) |

| (2) | Aggregate number of securities to which transaction applies:

|

| | (3) |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) |

| (4) | Proposed maximum aggregate value of transaction:

|

| | (5) |

| (5) | Total fee paid:

|

o |

|

|

o | Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

(3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

Table of Contents

| | | | |

| | Welcome to the

(4)Duke Energy Annual

Shareholder Meeting |

|

Date Filed:

|

March 20, 2014

March 17, 2011

Dear Shareholder:

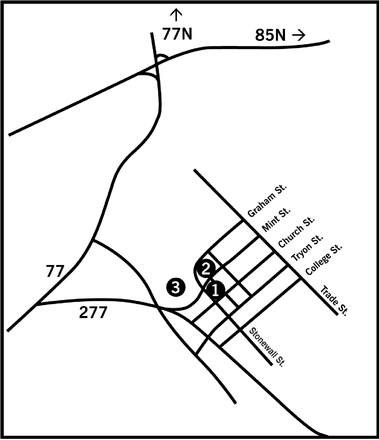

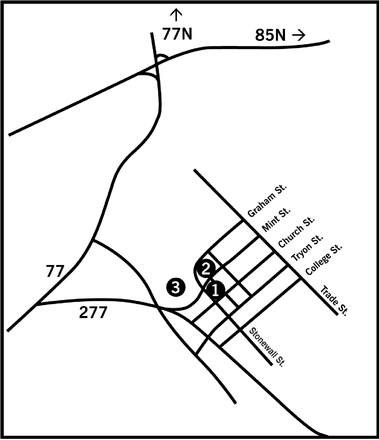

I am pleased to invite you to our annual shareholder meeting to be held on Thursday, May 5, 2011,1, 2014, at 10:00 a.m. in the O. J.O.J. Miller Auditorium located at our526 South Church Street in Charlotte, headquarters.North Carolina.

As explained in the enclosed proxy statement, at this year's meeting you will be asked to vote (i) for the election of directors, to ratify(ii) for the ratification of the selection of the independent public accountant, to make(iii) for the approval, on an advisory vote onbasis, of Duke Energy Corporation's named executive officer compensation, (iv) for the amendment to make an advisory vote on the frequencyDuke Energy Corporation's Amended and Restated Certificate of an advisory vote on executive compensation,Incorporation to vote on threeauthorize shareholder action by less than unanimous written consent, (v) against two shareholder proposals, and (vi) to consider any other business that may properly come before the meeting.

Later in the year, we will be sending you materials in which you will be asked to vote on several items requiring the approval of our shareholders in connection with our proposed merger with Progress Energy. This year's proxy statement relates solelyincludes certain items such as a proxy statement summary on page 6 and certain charts and illustrations to help better explain our corporate governance and compensation programs and objectives. With this document, our aim is to communicate with you the annual business of Duke Energy.matters to be addressed at the meeting in a way that is simple and straightforward.

Your vote is important – exercise your shareholder right and vote your shares right away.

Please turn to page 12 for the instructions on how you can vote your shares over the Internet, by telephone or by mail. It is important that all Duke Energy shareholders, regardless of the number of shares owned, participate in the affairs of the Company. At Duke Energy's last annual meeting, in May 2010,2013 Annual Shareholder Meeting, approximately 8384 percent of Duke Energy'sthe Company's outstanding shares were represented in person or by proxy.

We hope you will find it possible to attend this year's annual shareholder meeting and thank you for your continued interest in Duke Energy.

| | |

Sincerely, | | |

| | |

Lynn J. Good | | |

Vice Chairman, President and Chief Executive Officer | | |

Table of Contents

PARTICIPATE IN THE FUTURE OF DUKE ENERGY;

CAST YOUR VOTE RIGHT AWAY

It is very important that you vote to play a part in the future of Duke Energy. New York Stock Exchange ("NYSE") rules state that if your shares are held through a broker, bank or other nominee, they cannot vote on your behalf on nondiscretionary matters.

Please cast your vote right away on all of the proposals listed below to ensure that your shares are represented.

Proposals That Require Your Vote

| | | | | | | | | | | | |

| |

| | More

information

| | Board

recommendation

| | Broker non-votes

| | Abstentions

| | Votes

required

for approval

|

|---|

|

|---|

| PROPOSAL 1 | | Election of directors | | Page 15 | | FOR each nominee | | Do not count | | Do not count | | Majority of votes cast, with a resignation policy |

|

PROPOSAL 2 |

|

Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for 2014 |

|

Page 33 |

|

FOR |

|

Vote for |

|

Vote against |

|

Majority of shares represented |

|

PROPOSAL 3 |

|

Approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation |

|

Page 35 |

|

FOR |

|

Do not count |

|

Vote against |

|

Majority of shares represented |

|

PROPOSAL 4 |

|

Approval of the amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent |

|

Page 68 |

|

FOR |

|

Vote against |

|

Vote against |

|

Majority of outstanding shares entitled to vote |

|

PROPOSAL 5 |

|

Shareholder proposal regarding shareholder right to call a special shareholder meeting |

|

Page 69 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of shares represented |

|

PROPOSAL 6 |

|

Shareholder proposal regarding political contribution disclosure |

|

Page 71 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of shares represented |

|

Vote Right Away

Even if you plan to attend this year's meeting, it is a good idea to vote your shares now, before the meeting, in the event your plans change. Whether you vote by Internet, by telephone or by mail, please have your proxy card or voting instruction form in hand and follow the instructions.

| | | | |

|

By Internet using your computer | |

By telephone | | By mailing your

proxy card |

|

|

|

|

|

Visit 24/7

www.proxyvote.com |

|

Dial toll-free 24/7

1-800-690-6903

or by calling the

number provided

by your broker, bank

or other nominee if your shares are not registered in your name. |

|

Cast your ballot,

sign your proxy card

and send free of postage. |

|

DUKE ENERGY – 2014 Proxy Statement 3

Back to Contents

PARTICIPATE IN THE FUTURE OF DUKE ENERGY;

CAST YOUR VOTE RIGHT AWAY

Visit Our Website

| | |

Visit our website

http://www.duke-energy.com/investors/news-events.asp | | • Review and download this proxy statement and our annual report • Listen to a live audio stream of the meeting |

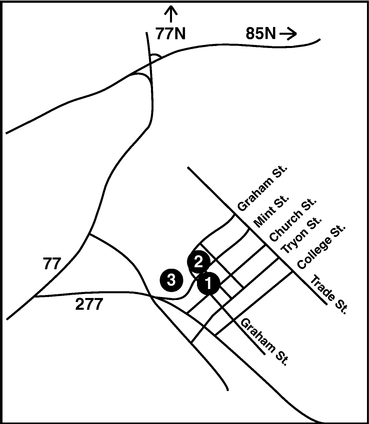

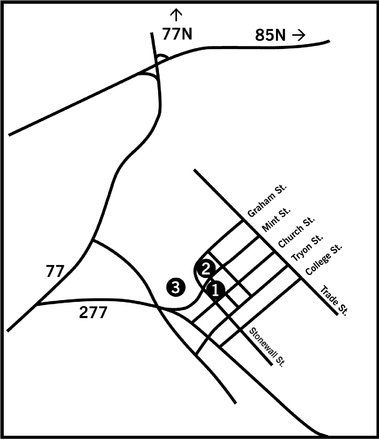

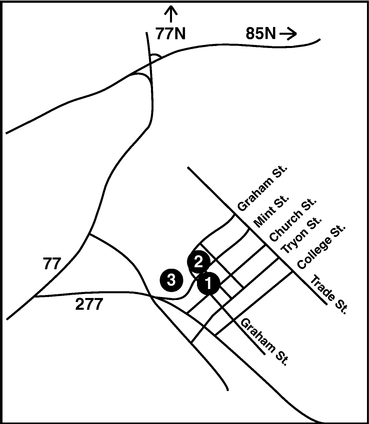

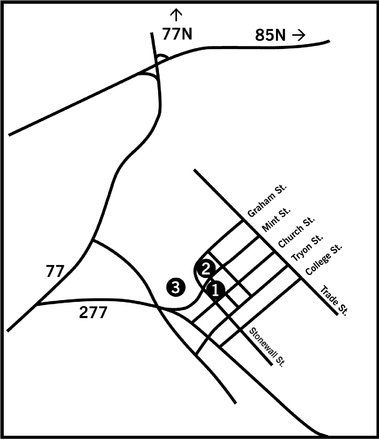

Attend Our 2014 Annual Shareholder Meeting

| | |

|

|

10:00 a.m. (EST) on Thursday, May 1, 2014

O.J. Miller Auditorium

526 South Church Street

Charlotte, NC 28202

Directions to 526 South Church Street are provided on the inside back cover.

526 South Church Street 526 South Church Street

Mint Street Parking Deck Mint Street Parking Deck

Bank of America Stadium Bank of America Stadium |

4 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

Table of Contents

DUKE ENERGY – 2014 Proxy Statement 5

Table of Contents

This proxy statement was first made available to shareholders on or about March 20, 2014.

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider. You should read the entire proxy statement carefully before voting. Page references ("XX") are supplied to help you find further information in this proxy statement.

Eligibility to Vote (page 11)

You can vote if you were a shareholder of record at the close of business on March 3, 2014.

How to Cast Your Vote (page 12)

You can vote by any of the following methods:

| | | | | | | | |

| | | | | | | | |

By Internet using your

computer

| | By telephone

| | By mailing your

proxy card

| | In person

| |

|

|---|

|

|

|

|

|

|

|

|

|

Visit 24/7

www.proxyvote.com | |

Dial toll-free 24/7

1-800-690-6903

or by calling the

number provided

by your broker, bank

or other nominee if your shares are not registered in your name. | |

Cast your ballot, sign

your proxy card and

send free of postage. | | At the annual shareholder meeting: If you are a shareholder of record, you may be admitted to the meeting by bringing your notice, proxy card or, if your shares are held in the name of a broker, bank or other nominee, an account statement or letter from the nominee indicating your ownership as of the record date, along with some form of government-issued identification. | | |

| | | | | | | | |

Business Highlights

Duke Energy's regulated utility operations provide electricity to 7.2 million customers located in six states in the Southeast and Midwest United States, representing a population of approximately 22 million people. Our nonregulated businesses own and operate diverse power generation assets in North America and Latin America, including a growing portfolio of renewable energy assets in the United States. Duke Energy operates in the United States, primarily through its direct and indirect wholly owned subsidiaries, Duke Energy Carolinas, LLC; Duke Energy Progress, Inc.; Duke Energy Florida, Inc.; Duke Energy Ohio, Inc.; Duke Energy Kentucky, Inc.; and Duke Energy Indiana, Inc., as well as in Latin America through Duke Energy International, LLC.

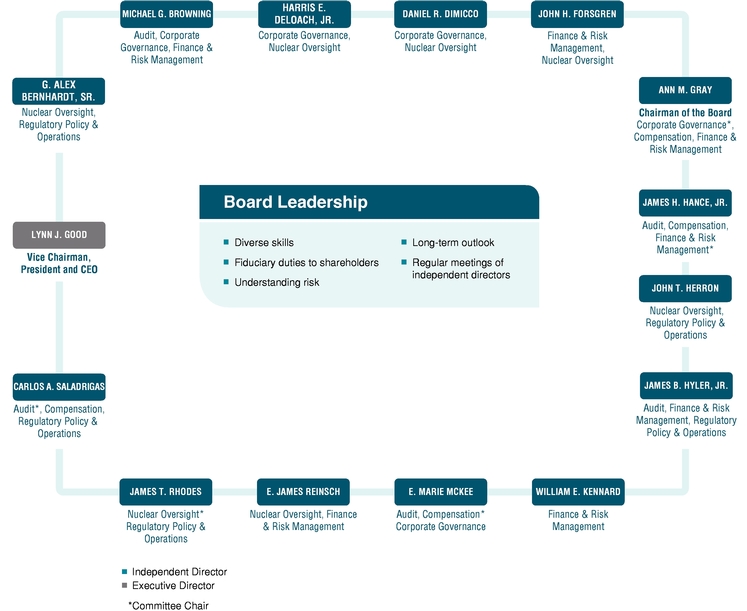

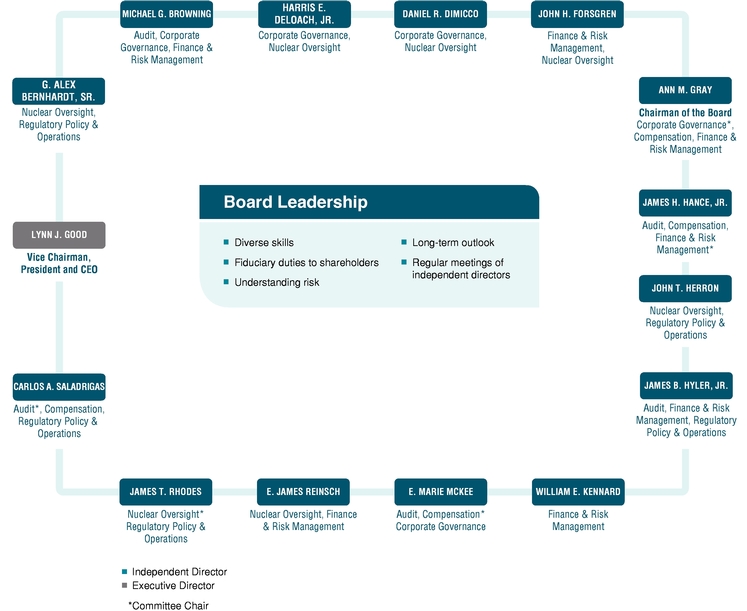

Governance of the Company (page 21)

- •

- Board Leadership Structure

- •

- Meeting Attendance

- •

- Risk Oversight

- •

- Director Independence

- •

- Committees and Attendance

- •

- Director Qualification Standards

- •

- Criteria for Board Membership

- •

- Majority Vote Standard

- •

- Communications with Directors

6 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

Board Nominees (page 15)

| | | | | | | | | | | | | | | | |

| |

| |

| |

| | Independent (Yes/No) | |

| |

|

|---|

| |

| | Director

since

| |

| | Committee

Memberships

| | Other Public

Company Boards

|

|---|

Name

| | Age

| | Occupation

| | Yes

| | No

|

|---|

| |

|---|

G. Alex Bernhardt, Sr. | | | 70 | | | 1991 | | Chairman, Bernhardt Furniture Company | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | None |

| |

Michael G. Browning | | | 67 | | | 1990 | | Chairman, Browning Investments, Inc. | | X | | | | • Audit • Corporate Governance • Finance and Risk Management | | None |

| |

Harris E. DeLoach, Jr. | | | 69 | | | 2006 | | Executive Chairman, Sonoco Products Company | | X | | | | • Corporate Governance • Nuclear Oversight | | • Sonoco Products Company • Goodrich Corporation |

| |

Daniel R. DiMicco | | | 63 | | | 2007 | | Retired Chairman, President and Chief Executive Officer, Nucor Corporation | | X | | | | • Corporate Governance • Nuclear Oversight | | None |

| |

John H. Forsgren | | | 67 | | | 2009 | | Retired Vice Chairman, Executive Vice President and Chief Financial Officer, Northeast Utilities | | X | | | | • Finance and Risk Management • Nuclear Oversight | | • The Phoenix Companies, Inc. |

| |

Lynn J. Good

Vice Chairman | | | 54 | | | 2013 | | Vice Chairman, President and Chief Executive Officer, Duke Energy Corporation | | | | X | | None | | • Hubbell Incorporated |

| |

Ann M. Gray

Chairman of the Board | | | 68 | | | 1994 | | Former Vice President, ABC, Inc. and former President, Diversified Publishing Group, ABC, Inc. | | X | | | | • Compensation • Corporate Governance • Finance and Risk Management | | • The Phoenix Companies, Inc. |

| |

James H. Hance, Jr. | | | 69 | | | 2005 | | Retired Vice Chairman and Chief Financial Officer, Bank of America Corporation | | X | | | | • Audit • Compensation • Finance and Risk Management | | • Cousins Properties Incorporated • Ford Motor Company • The Carlyle Group, LP |

| |

John T. Herron | | | 60 | | | 2013 | | Retired President, Chief Executive Officer and Chief Nuclear Officer, Entergy Nuclear | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | None |

| |

James B. Hyler, Jr. | | | 66 | | | 2008 | | Managing Director, Investors Management Corporation | | X | | | | • Audit • Finance and Risk Management • Regulatory Policy and Operations | | None |

| |

William E. Kennard | | | 57 | | | 2014 | | Senior Advisor, Grain Management | | X | | | | • Finance and Risk Management | | • MetLife, Inc. |

| |

E. Marie McKee | | | 63 | | | 1999 | | President, Corning Museum of Glass | | X | | | | • Audit • Compensation • Corporate Governance | | None |

| |

E. James Reinsch | | | 70 | | | 2009 | | Retired Senior Vice President and Partner, Bechtel Group and past President, Bechtel Nuclear | | X | | | | • Finance and Risk Management • Nuclear Oversight | | None |

| |

James T. Rhodes | | | 72 | | | 2001 | | Retired Chairman, President and Chief Executive Officer, Institute of Nuclear Power Operations | | X | | | | • Nuclear Oversight • Regulatory Policy and Operations | | None |

| |

Carlos A. Saladrigas | | | 65 | | | 2001 | | Chairman, Regis HR Group, Concordia Healthcare Holdings, LLC | | X | | | | • Audit • Compensation • Regulatory Policy and Operations | | • Advance Auto Parts, Inc. |

| |

DUKE ENERGY – 2014 Proxy Statement 7

Table of Contents

Named Executive Officers (page 36)

| | | | | | | | | | |

Name

| | Age

| | Occupation

| | Since

| | Previous occupation

|

|---|

| |

|---|

Lynn J. Good | | | 54 | | Vice Chairman, President and Chief Executive Officer | | | 2013 | | Chief Financial Officer of Duke Energy from July 2009 through June 2013; President, Commercial Businesses of Duke Energy from November 2007 through June 2009 |

| |

Steven K. Young | | | 55 | | Executive Vice President and Chief Financial Officer | | | 2013 | | Vice President, Chief Accounting Officer and Controller of Duke Energy from July 2012 until August 2013; Senior Vice President and Controller of Duke Energy from December 2006 until July 2012 |

| |

Marc E. Manly | | | 62 | | Executive Vice President and President, Commercial Businesses | | | 2012 | | Chief Legal Officer of Duke Energy from April 2006 until December 2012 |

| |

Dhiaa M. Jamil | | | 57 | | Executive Vice President and President, Duke Energy Nuclear | | | 2013 | | Chief Nuclear Officer of Duke Energy from 2008 until March 2013; Chief Generation Officer of Duke Energy from July 2009 until March 2013; Senior Vice President, Nuclear Support of Duke Energy Carolinas, LLC from January 2007 to February 2008 |

| |

Lloyd M. Yates | | | 53 | | Executive Vice President, Regulated Utilities | | | 2012 | | Executive Vice President, Customer Operations of Duke Energy from July 2012 until December 2012; President and Chief Executive Officer of Duke Energy Progress, Inc. from July 2007 until June 2012 |

| |

- *

- Other Named Executive Officers include James E. Rogers, President and Chief Executive Officer of Duke Energy until June 30, 2013, and Chairman of the Board until his retirement on December 31, 2013.

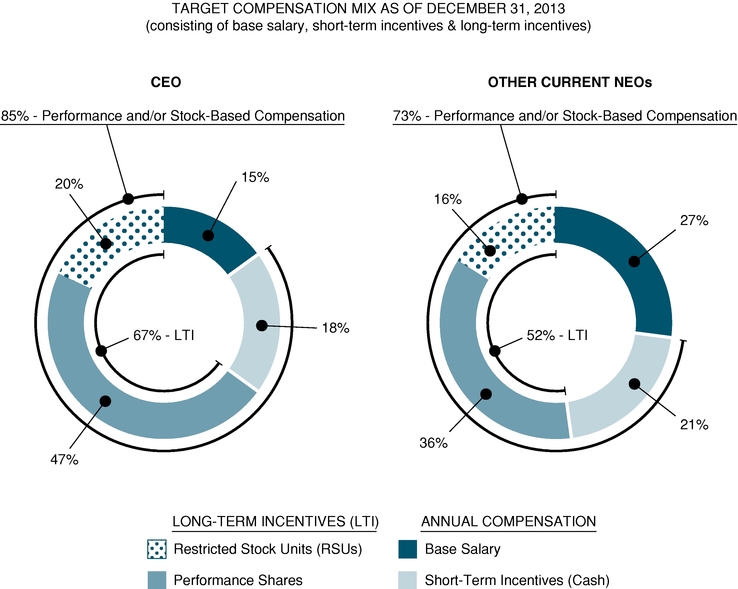

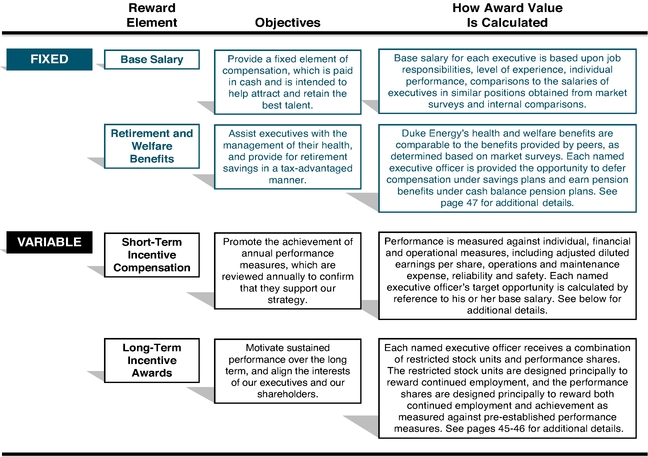

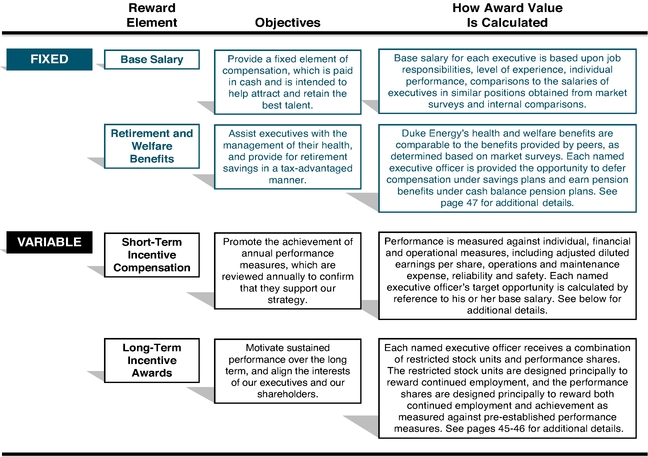

Executive Compensation (page 36)

Principles and Objectives (page 36)

Our executive compensation program is designed to:

- •

- Link pay to performance

- •

- Attract and retain talented executive officers and key employees

- •

- Emphasize performance-based compensation to motivate executives and key employees

- •

- Reward individual performance

- •

- Encourage long-term commitment to Duke Energy and align the interests of executives with shareholders

We meet these objectives through the appropriate mix of compensation, including:

- •

- Base salary

- •

- Short-term incentives

- •

- Long-term incentives

8 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

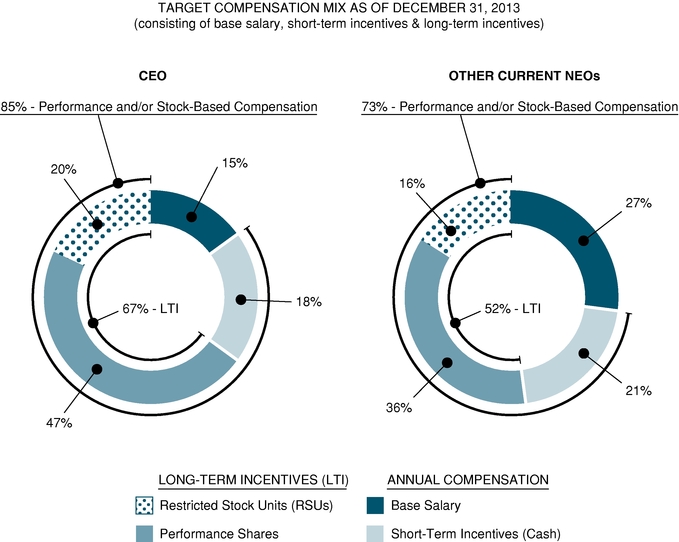

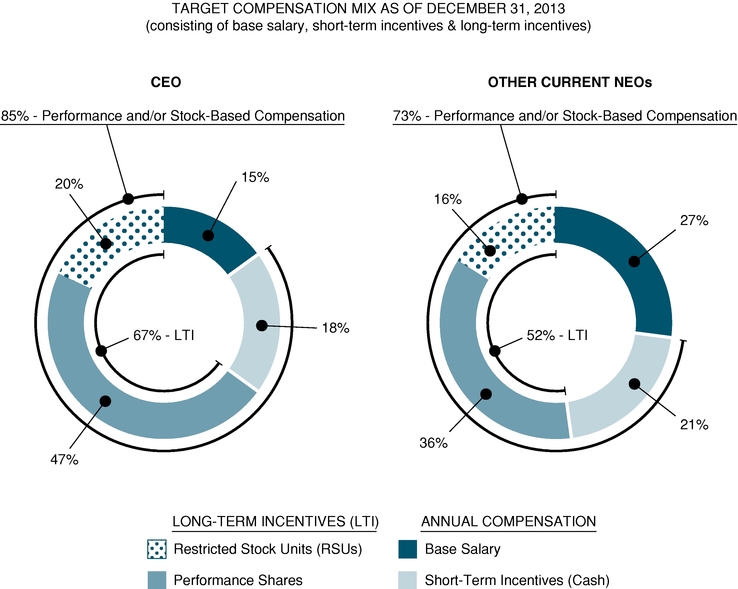

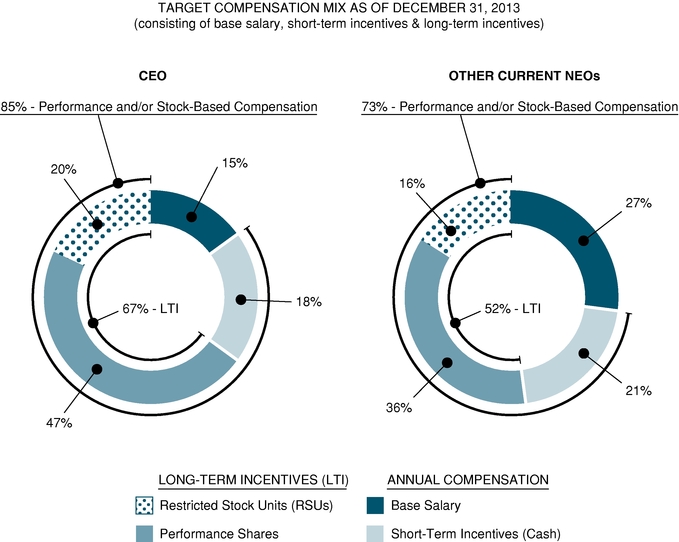

2013 Executive Total Compensation Mix (page 37)

Independent Public Accountant (page 33)

As a matter of good corporate governance, we are asking our shareholders to ratify the selection of Deloitte & Touche LLP as our independent public accountant for 2014.

Voting Matters (page 11)

| | | | | | | |

| | Board Vote

Recommendation

| | Page Reference

(for more detail)

| |

|---|

| |

|---|

| Management Proposals | | | | | | | |

| |

| Election of Directors | | | FOR each nominee | | | 15 | |

| |

| Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for 2014 | | | FOR | | | 33 | |

| |

| Approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation | | | FOR | | | 35 | |

| |

| Amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent | | | FOR | | | 68 | |

| |

| Shareholder Proposals | | | | | | | |

| |

| Shareholder proposal regarding shareholder right to call a special shareholder meeting | | | AGAINST | | | 69 | |

| |

| Shareholder proposal regarding political contribution disclosure | | | AGAINST | | | 71 | |

| |

DUKE ENERGY – 2014 Proxy Statement 9

Table of Contents

| | |

|

|

Notice of Annual Shareholder

Meeting |

|

|

|

May 1, 2014

10:00 a.m.

O.J. Miller Auditorium

526 South Church Street

Charlotte, North Carolina 28202

We will convene the annual shareholder meeting of Duke Energy Corporation on Thursday, May 1, 2014, at 10:00 a.m. in the O.J. Miller Auditorium located at 526 South Church Street in Charlotte, North Carolina.

The purpose of the annual meeting is to consider and take action on the following:

- 1.

- Election of directors;

- 2.

- Ratification of Deloitte & Touche LLP as Duke Energy Corporation's independent public accountant for 2014;

- 3.

- Approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation;

- 4.

- Amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent;

- 5.

- A shareholder proposal regarding shareholder right to call a special shareholder meeting;

- 6.

- A shareholder proposal regarding political contribution disclosure; and

- 7.

- Any other business that may properly come before the meeting (or any adjournment or postponement of the meeting).

Shareholders of record as of the close of business on March 3, 2014, are entitled to vote at the annual shareholder meeting. It is important that your shares are represented at this meeting.

This year we will again be using the Securities and Exchange Commission ("SEC") rule that allows us to provide our proxy materials to our shareholders overvia the internet.Internet. By doing so, most of our shareholders will only receive a notice containing instructions on how to access the proxy materials overvia the internetInternet and vote online, by telephone or by mail. If you would still like to request paper copies of the proxy materials, you may follow the instructions on the notice. If you receive paper copies of the proxy materials, we ask you to consider signing up to receive these materials electronically in the future by following the instructions contained in this proxy statement. By delivering proxy materials electronically, we can reduce the consumption of natural resources and the cost of printing and mailing our proxy materials.

Even if you plan to attend this year's meeting, it is a good idea to vote your shares now, before the meeting, in the event your plans change. This notice and proxy statement contains instructions on how you can vote your shares over the internet, by telephone or by mail. Whether you choose to vote by mail, telephone or internet, your response is greatly appreciated.

We hope you will find it possible to attend this year's annual meeting, and thank you for your continued interest in Duke Energy.

| | |

| | Sincerely, |

|

|

|

| | James E. Rogers

Chairman, President and

Chief Executive Officer |

Duke Energy Corporation

526 South Church Street

Charlotte, NC 28202-1802

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 5, 2011

March 17, 2011

We will convene the annual meeting of shareholders of Duke Energy Corporation on Thursday, May 5, 2011, at 10:00 a.m. in the O. J. Miller Auditorium located at our Charlotte headquarters at 526 South Church Street in Charlotte, North Carolina.

The purpose of the annual meeting is to consider and take action on the following:

1.Election of directors;

2.Ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2011;

3.Advisory vote on executive compensation;

4.Advisory vote on the frequency of an advisory vote on executive compensation;

5.A shareholder proposal relating to preparation of a report on Duke Energy's global warming-related lobbying activities;

6.A shareholder proposal regarding the issuance of a report on the financial risks of continued reliance on coal;

7.A shareholder proposal regarding an amendment to our organizational documents to require majority voting for the election of directors; and

8.Any other business that may properly come before the meeting (or any adjournment or postponement of the meeting).

Shareholders of record as of the close of business on March 10, 2011, are entitled to vote at the annual meeting. It is important that your shares be represented at this meeting.

Whether or not you expect to be present at the annual shareholder meeting, please take time to vote now. If you choose to vote by mail, you may do so by marking, dating and signing the proxy card and returning it to us. You may also vote by telephone or internet. Please follow the voting instructions that are included on your proxy card. Regardless of the manner in which you vote, we urge and greatly appreciate your prompt response.

| | |

| Dated: March 20, 2014 | | By order of the Board of Directors, |

|

|

|

| | | Marc E. ManlyJulie S. Janson

Group Executive Vice President, Chief Legal Officer

and Corporate Secretary |

TABLE OF CONTENTS

| | | | |

| | Page | |

|---|

Frequently Asked Questions and Answers about the Annual Meeting

| | | 1 | |

Proposal 1: Election of Directors

| | |

5 | |

Information on the Board of Directors

| | |

11 | |

Proposal 2: Ratification of Deloitte & Touche LLP as Duke Energy Corporation's Independent Public Accountant for 2011

| | |

21 | |

Proposal 3: Advisory Vote on Executive Compensation

| | |

22 | |

Proposal 4: Advisory Vote on the Frequency of an Advisory Vote on Executive Compensation

| | |

23 | |

Shareholder Proposals

| | |

24 | |

Proposal 5: Shareholder Proposal Relating to Preparation of a Report on Duke Energy Corporation's Global Warming-Related Lobbying Activities

| | |

24 | |

Proposal 6: Shareholder Proposal Regarding the Issuance of a Report on the Financial Risks of Continued Reliance on Coal

| | |

27 | |

Proposal 7: Shareholder Proposal Regarding an Amendment to our Organizational Documents to Require Majority Voting for the Election of Directors

| | |

29 | |

Security Ownership of Certain Beneficial Owners and Management

| | |

31 | |

Report of the Audit Committee

| | |

33 | |

Report of the Corporate Governance Committee

| | |

35 | |

Report of the Compensation Committee

| | |

39 | |

Compensation Discussion and Analysis

| | |

40 | |

Executive Compensation

| | |

62 | |

Other Information

| | |

83 | |

This proxy statement was first made available to shareholders on or about March 17, 2011.10 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

On what am I voting?

| | | | | | | | | | | | |

Q: | | |

| |

| | On what am I voting?More

information

| | Board

recommendation

| | Broker non-votes

| | Abstentions

| | Votes

required

for approval

|

|---|

|

|---|

A:PROPOSAL 1 |

|

•Election of directors |

|

ElectionPage 15 |

|

FOR each

nominee |

|

Do not count |

|

Do not count |

|

Majority of directors;votes cast, with a resignation policy |

|

|

•PROPOSAL 2 |

|

Ratification of Deloitte & Touche LLP ("Deloitte") as Duke Energy Corporation's ("Duke Energy" or the "Company") independent public accountant for 2011; |

|

|

•2014 |

|

Advisory vote on executive compensation; |

|

|

•Page 33 |

|

Advisory vote on the frequency of an advisory vote on executive compensation; |

|

|

•FOR |

|

A shareholder proposal relating to preparation of a report on Duke Energy's global warming-related lobbying activities; |

|

|

•Vote for |

|

A shareholder proposal relating to the issuance of a report on the financial risks of continued reliance on coal; and |

|

|

•Vote against |

|

A shareholder proposal regarding an amendment to our organizational documents to require majority voting for the electionMajority of directors.

shares

represented |

|

Q: |

PROPOSAL 3 |

|

Who can vote?Approval, on an advisory basis, of Duke Energy Corporation's named executive officer compensation |

|

Page 35 |

|

FOR |

|

Do not count |

|

Vote against |

|

Majority of

shares

represented |

|

A: |

PROPOSAL 4 |

|

HoldersAmendment to Duke Energy Corporation's Amended and Restated Certificate of Duke Energy's common stock asIncorporation to authorize shareholder action by less than unanimous written consent |

|

Page 68 |

|

FOR |

|

Vote against |

|

Vote against |

|

Majority of the close of business on the record date, March 10, 2011, are

outstanding shares

entitled to vote either in person or by proxy, at the annual meeting. Each share of Duke Energy common stock has one vote. |

|

Q: |

PROPOSAL 5 |

|

How do I vote?Shareholder proposal regarding shareholder right to call a special shareholder meeting |

|

Page 69 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of

shares

represented |

|

A: |

PROPOSAL 6 |

|

By ProxyShareholder proposal regarding political contribution disclosure |

|

—Page 71 |

|

AGAINST |

|

Do not count |

|

Vote against |

|

Majority of

shares

represented |

|

Who can vote?

Holders of Duke Energy's common stock as of the close of business on the record date, March 3, 2014, are entitled to vote, either in person or by proxy, at the annual shareholder meeting. Each share of Duke Energy common stock has one vote.

DUKE ENERGY – 2014 Proxy Statement 11

Back to Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

How do I vote?

By Proxy – Before the annual shareholder meeting, you can give a proxy to vote your shares of Duke Energy common stock in one of the following ways:

|

|

• |

|

by telephone; |

|

|

• |

|

by internet; or |

|

|

• |

|

by completing and signing your proxy card and mailing it in time to be received prior to the annual meeting. |

|

|

The telephone and internet voting procedures are designed to confirm your identity, to allow you to give your voting instructions and to verify that your instructions have been properly recorded. If you wish to vote by telephone or internet, please follow the instructions that are included on your notice. |

Table of Contents

| | | | | |

| | | If you mail us | | | |

| | | | | |

| By Internet using your properly completed and signed proxy card, or vote bycomputer

| | By telephone or internet, your shares of Duke Energy common stock will be voted according to the choices that you specify. If you sign and mail

| | By mailing your proxy card without marking any choices, your proxy will be voted:

|

|---|

|

| |

| |

|

|

|

•Visit 24/7

www.proxyvote.com |

|

FORDial toll-free 24/7

1-800-690-6903

or by calling the election of all nominees for director; |

| number provided

| by your broker, bank

•or other nominee if your shares

are not registered in your name. |

|

FOR the ratificationCast your ballot,

sign your proxy card

and send free of Deloitte as Duke Energy's independent public accountant for 2011;postage. |

|

|

• |

|

FOR the approval of executive compensation; |

|

|

• |

|

FOR the option of every one year as the preferred frequency for holding an advisory vote on executive compensation; |

|

|

• |

|

AGAINST the shareholder proposal relating to preparation of a report on Duke Energy's global warming-related lobbying activities; |

|

|

• |

|

AGAINST the shareholder proposal regarding the issuance of a report on the financial risks of continued reliance on coal; and |

|

|

• |

|

AGAINST the shareholder proposal regarding an amendment to our organizational documents to require majority voting for the election of directors. |

|

|

We do not expect that any other matters will be brought before the annual meeting. However, by giving your proxy, you appoint the persons named as proxies as your representatives at the annual meeting. If an issue should arise for vote at the annual meeting that is not included in the proxy material, the proxy holders will vote your shares in accordance with their best judgment. |

|

|

In Person—You may come to the annual meeting and cast your vote there. If your shares are held in the name of your broker, bank or other nominee and you wish to vote at the annual meeting, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares on March 10, 2011. |

Q: |

|

May I change or revoke my vote? |

A: |

|

Yes. You may change your vote or revoke your proxy at any time prior to the annual meeting by: |

|

|

• |

|

notifying Duke Energy's Corporate Secretary in writing that you are revoking your proxy; |

|

|

• |

|

providing another signed proxy that is dated after the proxy you wish to revoke; |

|

|

• |

|

using the telephone or internet voting procedures; or |

|

|

• |

|

attending the annual meeting and voting in person. |

The telephone and Internet voting procedures are designed to confirm your identity, to allow you to give your voting instructions and to verify that your instructions have been properly recorded. If you wish to vote by telephone or Internet, please follow the instructions that are included on your notice.

If you mail us your properly completed and signed proxy card or vote by telephone or Internet, your shares of Duke Energy common stock will be voted according to the choices that you specify. If you sign and mail your proxy card without marking any choices, your proxy will be voted:

- •

- FOR the election of all nominees for director;

•FOR the ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2014;

•FOR the approval, on an advisory basis, of Duke Energy's named executive officer compensation;

•FOR the approval of the amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent;

•AGAINST the shareholder proposal regarding shareholder right to call a special shareholder meeting; and

•AGAINST the shareholder proposal regarding political contribution disclosure.We do not expect that any other matters will be brought before the annual shareholder meeting. However, by giving your proxy, you appoint the persons named as proxies as your representatives at the annual shareholder meeting.

In Person – You may come to the annual shareholder meeting and cast your vote there. You may be admitted to the meeting by bringing your notice, proxy card or, if your shares are held in the name of your broker, bank or other nominee, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares on March 3, 2014, along with some form of government-issued identification.

May I change or revoke my vote?

Yes. You may change your vote or revoke your proxy at any time prior to the annual shareholder meeting by:

- •

- notifying Duke Energy's Corporate Secretary in writing that you are revoking your proxy;

- •

- providing another signed proxy that is dated after the proxy you wish to revoke;

- •

- using the telephone or Internet voting procedures; or

- •

- attending the annual shareholder meeting and voting in person.

Will my shares be voted if I do not provide my proxy?

It depends on whether you hold your shares in your own name or in the name of a bank or brokerage firm. If you hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote in person at the meeting.

Brokerage firms generally have the authority to vote their customers' unvoted shares on certain "routine" matters. If your shares are held in the name of a broker, bank or other nominee, such nominee can vote your shares for the ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2014 if you do not timely provide your proxy because this matter is considered "routine" under the applicable rules. However, no other items are considered "routine" and may not be voted by your broker without your instruction.

12 DUKE ENERGY – 2014 Proxy Statement

TableBack to Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

If I am a participant in the Duke Energy Retirement Savings Plan or the Savings Plan for Employees of ContentsFlorida Progress Corporation, how do I vote shares held in my plan account?

If you are a participant in either of the plans listed above, you have the right to provide voting directions to the plan trustee, by submitting your proxy card, for those shares of Duke Energy common stock that are held by the plan and allocated to your account. Plan participant proxies are treated confidentially.

If you elect not to provide voting directions to the plan trustee, the plan trustee will vote the Duke Energy shares allocated to your plan account in the same proportion as those shares held by the plan for which the plan trustee has received voting directions from other plan participants. The plan trustee will follow participants' voting directions and the plan procedure for voting in the absence of voting directions, unless it determines that to do so would be contrary to the Employee Retirement Income Security Act of 1974.

The plan trustee for each of the respective plans is as follows:

- •

- Duke Energy Retirement Savings Plan – Fidelity Management Trust Company

- •

- Savings Plan for Employees of Florida Progress Corporation – Vanguard Fiduciary Trust Company

Because the plan trustee must process voting instructions from participants before the date of the annual shareholder meeting, you must deliver your instructions no later than April 28, 2014, at 11:59 p.m.

| | | | |

What constitutes a quorum?

As of the record date, 706,954,889 shares of Duke Energy common stock were issued and outstanding and entitled to vote at the annual shareholder meeting. In order to conduct the annual shareholder meeting, a majority of the shares entitled to vote must be present in person or by proxy. This is referred to as a "quorum." If you submit a properly executed proxy card or vote by telephone or on the Internet, you will be considered part of the quorum. Abstentions and broker "non-votes" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" is not, however, counted as present and entitled to vote for purposes of voting on individual proposals other than ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant. A broker "non-vote" occurs when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under NYSE listing standards, does not have discretionary authority to vote on a matter. What vote is needed to approve the matters submitted?

- •

- Election of directors. Directors are elected by a majority of the votes cast at the meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote for this proposal. If any nominee does not receive a majority of "FOR" votes, such nominee is required to submit his or her resignation for consideration by the Board of Directors.

Q:

| | Will my shares be voted if I do not provide my proxy? |

A: |

|

It depends on whether you hold your shares in your own name or in the name of a bank or brokerage firm. If you hold your shares directly in your own name, they will not be voted unless you provide a proxy or vote in person at the meeting. |

|

|

Brokerage firms generally have the authority to vote customers' unvoted shares on certain "routine" matters. If your shares are held in the name of a brokerage firm, the brokerage firm can vote your shares for the ratification of Deloitte as Duke Energy's independent public accountant for 2011 if you do not timely provide your proxy because this matter is considered "routine" under the applicable rules. The other items are not considered "routine" and therefore may not be voted by your broker without instruction. |

Q: |

|

As a participant in the Duke Energy Retirement Savings Plan, the Duke Energy Retirement Savings Plan for Legacy Cinergy Union Employees (Midwest) or the Duke Energy Retirement Savings Plan for Legacy Cinergy Union Employees (IBEW 1393), how do I vote shares held in my plan account? |

A: |

|

If you are a participant in any of these plans, you have the right to provide voting directions to the plan trustee, by submitting your proxy card, for those shares of Duke Energy common stock that are held by the plan and allocated to your account. Plan participant proxies are treated confidentially. |

|

|

If you elect not to provide voting directions to the plan trustee, the plan trustee will vote the Duke Energy shares allocated to your plan account in the same proportion as those shares held by the plan for which the plan trustee has received voting directions from other plan participants. The plan trustee will follow participants' voting directions and the plan procedure for voting in the absence of voting directions, unless it determines that to do so would be contrary to the Employee Retirement Income Security Act of 1974. Because the plan trustee must process voting instructions from participants before the date of the annual meeting, you are urged to deliver your instructions no later than April 29, 2011. |

Q: |

|

What constitutes a quorum? |

A: |

|

As of the record date, 1,331,086,471 shares of Duke Energy common stock were issued and outstanding and entitled to vote at the annual meeting. In order to conduct the annual meeting, a majority of the shares entitled to vote must be present in person or by proxy. This is referred to as a "quorum." If you submit a properly executed proxy card or vote by telephone or on the internet, you will be considered part of the quorum. Abstentions and broker "non-votes" will be counted as present and entitled to vote for purposes of determining a quorum. A broker "non-vote" occurs when a bank, broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under New York Stock Exchange ("NYSE") listing standards, does not have discretionary authority to vote on a matter. |

•Ratification of Deloitte & Touche LLP as Duke Energy's independent public accountant for 2014. The affirmative vote of a majority of the shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have the same effect as votes for this proposal.

•Approval, on an advisory basis, of Duke Energy's named executive officer compensation. The affirmative vote of a majority of shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

•Approval of the amendment to Duke Energy Corporation's Amended and Restated Certificate of Incorporation to authorize shareholder action by less than unanimous written consent. The affirmative vote of a majority of outstanding shares entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have the same effect as votes against this proposal.

•Shareholder proposal regarding shareholder right to call a special shareholder meeting. The affirmative vote of a majority of the shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.

•Shareholder proposal regarding political contribution disclosure. The affirmative vote of a majority of the shares present and entitled to vote at the annual shareholder meeting is required to approve this proposal. Abstentions will have the same effect as votes against this proposal. Broker non-votes will have no effect on the outcome of the vote for this proposal.DUKE ENERGY – 2014 Proxy Statement 13

TableBack to Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL SHAREHOLDER MEETING

Who conducts the proxy solicitation and how much will it cost?

Duke Energy is requesting your proxy for the annual shareholder meeting and will pay all the costs of Contentsrequesting shareholder proxies. We have hired Georgeson Inc. to help us send out the proxy materials and request proxies. Georgeson's fee for these services is $21,000, plus out-of-pocket expenses. We can request proxies through the mail or personally by telephone, fax or Internet. We can use directors, officers and other employees of Duke Energy to request proxies. Directors, officers and other employees will not receive additional compensation for these services. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of Duke Energy common stock.

14 DUKE ENERGY – 2014 Proxy Statement

| | | | |

Q: | | What vote is needed to approve the matters submitted? |

A: |

|

Directors are elected by a plurality of the votes cast at the meeting, subject to the Board of Directors' policy regarding resignations for directors who do not receive a majority of "FOR" votes. "Plurality" means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. The affirmative vote of a majority of the shares present and entitled to vote at the annual meeting is required to approve the ratification of Deloitte as Duke Energy's independent public accountant for 2011, the advisory vote on executive compensation, and each of the three shareholder proposals. In tabulating the vote on any of these matters other than the election of directors, abstentions will have the same effect as votes against the matter and shares that are the subject of a broker "non-vote" will be deemed absent and will have no effect on the outcome of the vote. |

|

|

For the advisory vote on the frequency of an advisory vote on executive compensation, the frequency receiving the greatest number of votes (every one, two or three years) will be considered the frequency recommended by shareholders. Abstentions and broker non-votes will therefore have no effect on such vote. |

Q: |

|

Who conducts the proxy solicitation and how much will it cost? |

A: |

|

Duke Energy is requesting your proxy for the annual meeting and will pay all the costs of requesting shareholder proxies. We have hired Georgeson Shareholder Communications, Inc. to help us send out the proxy materials and request proxies. Georgeson's fee for these services is $21,000, plus out-of-pocket expenses. We can request proxies through the mail or personally by telephone, fax or other means. We can use directors, officers and other employees of Duke Energy to request proxies. Directors, officers and other employees will not receive additional compensation for these services. We will reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material to the beneficial owners of Duke Energy common stock. |

Table of Contents

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors

The Board of Directors of Duke Energy has nominated the following 1115 candidates to serve on the Board. We have a declassified Board of Directors, which means all of the directors are voted on every year at the annual shareholder meeting.

If any director is unable to stand for election, the Board of Directors may reduce the number of directors or designate a substitute. In that case, shares represented by proxies may be voted for a substitute director. We do not expect that any nominee will be unavailable or unable to serve. The Corporate Governance Committee, comprised of only independent directors, has recommended each of the following current directors as nominees for directorsdirector and the Board of Directors has approved their nomination for election:election. Two of our current directors, Messrs. Barnet and Sharp, will be retiring at our 2014 Annual Shareholder Meeting and therefore are not nominated for re-election.

DUKE ENERGY – 2014 Proxy Statement 15

Back to Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | |

| | William Barnet, III

Director of Duke Energy or its predecessor companies since 2005

Chairman, President and Chief Executive Officer

The Barnet Company Inc. and Barnet Development Corporation

Age 68

Mr. Barnet has served as Chairman, President and CEO of The Barnet Company Inc. since 2001 and Barnet Development Corporation since 1990. Both companies are real estate and investment firms. Mr. Barnet served two terms as mayor of Spartanburg, S.C. and is a former director of Bank of America. In March 2006, Mr. Barnet was named as a Trustee of the Duke Endowment.

Mr. Barnet's qualifications for election include his management experience, his understanding of Duke Energy's South Carolina service territory, and his knowledge of finance and risk management. | |

|

|

G. Alex Bernhardt, Sr.

|

| Independent Director Nominee | | | | |

| | Age: 70

Director of Duke Energy or its predecessor companies since 1991

Chairman, and CEO

Bernhardt Furniture Company

| | Age 67

Mr. Bernhardt has been associated with Bernhardt Furniture Company, a furniture manufacturer, since 1965. He was named PresidentSkills and a director in 1976 and became Chairman and CEO in 1996. Mr. Bernhardt is a director of Communities In Schools and the North Carolina Nature Conservancy.

Qualifications:• Mr. Bernhardt's qualifications for election include his management experience and his knowledge and understanding of industry in Duke Energy's North Carolina service territory. |

Table of Contents

| | |

| | Committees: • Nuclear Oversight Committee • Regulatory Policy and Operations Committee Other current public directorships: • None |

Mr. Bernhardt has been associated with Bernhardt Furniture Company, a furniture manufacturer, since 1965. He has served as Chairman since 1996 and a director since 1976. Previously he served as President from 1976 until 1996 and CEO from 1996 until 2011. Mr. Bernhardt is a director of Communities In Schools and a trustee of the North Carolina Nature Conservancy. |

Michael G. Browning

|

| Independent Director Nominee | | | | |

| | Age: 67

Director of Duke Energy or its predecessor companies since 1990

Chairman, and President

Browning Investments, Inc.

| | Age 64Skills and Qualifications:•

Mr. Browning's qualifications for election include his management experience and his knowledge and understanding of Duke Energy's Midwest service territory. Mr. Browning's financial and investment background adds a valuable perspective to the Board and its committees.

| | Committees: • Audit Committee • Corporate Governance Committee • Finance and Risk Management Committee Other current public directorships: • None |

Mr. Browning has been Chairman and President of Browning Investments, Inc., a real estate development firm, since 1981.1981, and served as President from 1981 until 2013. He also serves as owner, general partner or managing member of various real estate entities. Mr. Browning is a former director of Standard Management Corporation, Conseco, Inc. and Indiana Financial Corporation. |

Harris E. DeLoach, Jr.

|

| Independent Director Nominee | | | | |

| | Age: 69

Director of Duke Energy or its predecessor companies since 2006

Executive Chairman,

Sonoco Products Company | | Skills and Qualifications: • Mr. Browning'sDeLoach's qualifications for election include his managementknowledge of the economic and business development issues facing the communities we serve, his experience leading a public company with global operations and his knowledge and understanding of Duke Energy's midwestSouth Carolina service territory. Mr. Browning's financial and investment background adds a valuable perspective to the Board and its committees. | | Committees: • Corporate Governance Committee • Nuclear Oversight Committee Other current public directorships: • Sonoco Products Company • Goodrich Corporation |

|

16 DUKE ENERGY – 2014 Proxy Statement

Back to Contents

PROPOSAL 1: ELECTION OF DIRECTORS

|

|

| | | | |

Daniel R. DiMicco

|

| Independent Director Nominee | | | | |

| | Age: 63

Director of Duke Energy or its predecessor companies since 2007

Retired Chairman, President and Chief Executive Officer,

Nucor Corporation

| | Age 60

Mr. DiMicco has served as PresidentSkills and Chief Executive Officer of Nucor Corporation, a steel company, since 2000. He has been a member of the Nucor Board of Directors since 2000 and has served as its Chairman since 2006. Mr. DiMicco is a former chair of the American Iron and Steel Institute.

Qualifications:• Mr. DiMicco's qualifications for election include his management experience, including Chief Executive Officer of a Fortune 500 company and successfully operating a company serving many constituencies. In addition, Mr. DiMicco's experience as Chief Executive Officer of a large industrial corporation provides a valuable perspective on Duke Energy's industrial customer class. | | Committees: • Corporate Governance Committee • Nuclear Oversight Committee Other current public directorships: • None |

|

|

|

Table of Contents

| | Mr. DiMicco has served as Chairman Emeritus of Nucor Corporation, a steel company, since December 2013. From January 2013 until December 2013, Mr. DiMicco served as Executive Chairman of Nucor Corporation and as Chairman from May 2006 to December 2012, Chief Executive Officer from September 2000 to December 2012 and President from September 2000 to December 2010. He was a member of the Nucor Board of Directors from 2000 to 2013. Mr. DiMicco is a former chair of the American Iron and Steel Institute. |

| |

John H. Forsgren

|

| Independent Director Nominee | | | | |

| | Age: 67

Director of Duke Energy or its predecessor companies since 2009

Retired Vice Chairman, Executive Vice President and Chief Financial Officer,

Northeast Utilities

| | Age 64

Mr. Forsgren was Vice Chairman, Executive Vice PresidentSkills and Chief Financial Officer of Northeast Utilities from 1996 until his retirement in 2004. Mr. Forsgren also is currently a director of The Phoenix Companies, Inc. and of several privately held companies. He is a former director of CuraGen Corporation and Neon Communications Group, Inc.

Qualifications:• Mr. Forsgren's qualifications for election include his prior management and financial experience as Vice Chairman and Chief Financial Officer of a large utility company and his extensive knowledge of the energy industry and insight on renewable energy. | | Committees: • Finance and Risk Management Committee • Nuclear Oversight Committee Other current public directorships: • The Phoenix Companies, Inc. |

Mr. Forsgren has been Chairman of The Phoenix Companies, Inc. since 2013 and was Vice Chairman, Executive Vice President and Chief Financial Officer of Northeast Utilities from 1996 until his retirement in 2004. He is a former director of CuraGen Corporation and Neon Communications Group, Inc. |

|

Non-Independent Director Nominee

Vice Chairman of the Board | | | | |

| | Age: 54

Director of Duke Energy or its predecessor companies since 2013

Vice Chairman, President and Chief Executive Officer, Duke Energy Corporation | | Skills and Qualifications: • Ms. Good's qualifications for election include her experience as Chief Executive Officer and Chief Financial Officer of Duke Energy, her knowledge of the affairs of Duke Energy and its businesses, and her experience in the energy industry. | | Committees: • None Other current public directorships: • Hubbell Incorporated |

Ms. Good has served as Vice Chairman, President, Chief Executive Officer and a member of the Board of Directors of Duke Energy since July 2013. She served as Executive Vice President and Chief Financial Officer of Duke Energy from July 2009 through June 2013. Prior to that she served as President, Commercial Businesses from November 2007 through June 2009. |

DUKE ENERGY – 2014 Proxy Statement 17

Back to Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

Ann MaynardM. Gray

|

Independent Director Nominee

Chairman of the Board | | | | |

| | Age: 68

Director of Duke Energy or its predecessor companies since 1994

Former Vice President, ABC, Inc. and

Former former President, Diversified Publishing Group, of ABC, Inc.

| | Age 65

Ms. Gray was President, Diversified Publishing Group of ABC, Inc., a television, radioSkills and publishing company, from 1991 until 1997, and was a Corporate Vice President of ABC, Inc. and its predecessors from 1979 to 1998. Ms. Gray is currently a director of The Phoenix Companies, Inc. and a former director of Elan Corporation, plc.

Qualifications:• Ms. Gray's qualifications for election include her business experience, both from a management perspective and as a result of her experience as a director at several public companies. Ms. Gray's public company experience has also given her in-depth knowledge of governance principles, which she utilizes on a variety of matters, including, among other things, succession planning, executive compensation and corporate governance. |

Table of Contents

| | |

| | Committees: • Compensation Committee • Corporate Governance Committee • Finance and Risk Management Committee Other current public directorships: • The Phoenix Companies, Inc. |

Ms. Gray was President of Diversified Publishing Group of ABC, Inc., a television, radio and publishing company, from 1991 until 1997 and was a Corporate Vice President of ABC, Inc. and its predecessors from 1979 to 1998. Ms. Gray is a former director of Elan Corporation, plc and former trustee of JPMorgan Funds. |

James H. Hance, Jr.

|

| Independent Director Nominee | | | | |

| | Age: 69

Director of Duke Energy or its predecessor companies since 2005

Retired Vice Chairman and Chief Financial Officer,

Bank of America Corporation

| | Age 66

Mr. Hance was Vice Chairman of Bank of America from 1994 until his retirement in 2005Skills and served as Chief Financial Officer from 1988 to 2004. Since retiring in 2005, Mr. Hance has served as a director for various public companies, including Duke Energy Corporation. Mr. Hance is a certified public accountant and spent 17 years with Price Waterhouse (now PricewaterhouseCoopers LLP). He is currently a director of Sprint Nextel Corporation, Cousins Properties Incorporated, Morgan Stanley and Ford Motor Company and a former director of Bank of America, Rayonier Inc. and EnPro Industries, Inc. Mr. Hance also serves as a Senior Advisor to the Carlyle Group.

Qualifications:• Mr. Hance's qualifications for election include his management and financial experience as Vice Chairman and Chief Financial Officer of one of our nation's largest financial institutions, his broad background as a director of a number of large financial and industrial corporations, and his expertise in finance. | | Committees: • Audit Committee • Compensation Committee • Finance and Risk Management Committee Other current public directorships: • Cousins Properties Incorporated • Ford Motor Company • The Carlyle Group, LP |

Mr. Hance was Vice Chairman of Bank of America from 1994 until his retirement in 2005 and served as Chief Financial Officer from 1988 to 2004. Since retiring in 2005, Mr. Hance has served as a director for various public companies. He is a certified public accountant and spent 17 years with Price Waterhouse (now PricewaterhouseCoopers LLP). He is a former director of Bank of America, Rayonier Inc., Morgan Stanley and EnPro Industries, Inc. Mr. Hance also serves as an operating executive of The Carlyle Group, LP and is a member of its board of directors. |

|

| Independent Director Nominee |

| | | |

| | Age: 60

Director of Duke Energy or its predecessor companies since 2013

Retired President, Chief Executive Officer and Chief Nuclear Officer, Entergy Nuclear | | Skills and Qualifications: • Mr. Herron's qualifications for election include his knowledge and extensive insight gained at a variety of nuclear energy facilities over more than three decades, as well as his previous management experience in the energy industry. | | Committees: • Nuclear Oversight Committee • Regulatory Policy and Operations Committee Other current public directorships: • None |

Mr. Herron was President, Chief Executive Officer and Chief Nuclear Officer of Entergy Nuclear from 2009 until his retirement on March 31, 2013. Mr. Herron joined Entergy Nuclear in 2001 and held a variety of positions. He began his career in nuclear operations in 1979 and has held positions at a number of nuclear stations across the country. Mr. Herron is a director of Ontario Power Generation and also has served on the Institute of Nuclear Power Operations' board of directors. |

18 DUKE ENERGY – 2014 Proxy Statement

Back to Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

James B. Hyler, Jr.

|

| Independent Director Nominee | | | | |

| | Age: 66

Director of Duke Energy or its predecessor companies since 2008

Managing Director, Investors Management Corporation | | Skills and Qualifications: • Mr. Hyler's qualifications for election include his understanding of Duke Energy's North Carolina service territory and his knowledge and expertise in financial services and corporate finance. | | Committees: • Audit Committee • Finance and Risk Management Committee • Regulatory Policy and Operations Committee Other current public directorships: • None |

Mr. Hyler is Managing Director of Investors Management Corporation, a firm which invests in and acquires companies in various industries, since December 2011. He retired as Vice Chairman and Chief Operating Officer of First Citizens Bank in 2008, having served in these positions from 1994 until 2008. Mr. Hyler was President of First Citizens Bank from 1988 to 1994, and was Chief Financial Officer of First Citizens Bank from 1980 to 1988. Prior to joining First Citizens Bank, Mr. Hyler was an auditor with Ernst & Young for 10 years. Mr. Hyler served as a director of First Citizens BancShares from 1988 until 2008. |

William E. Kennard

|

| Independent Director Nominee | | | | |

| | Age: 57

Director of Duke Energy or its predecessor companies since 2014

Senior Advisor, Grain Management | | Skills and Qualifications: • Mr. Kennard's qualifications for election include his considerable experience and knowledge of the regulatory arena as well as his financial knowledge and international perspective. | | Committees: • Finance and Risk Management Committee Other current public directorships: • MetLife, Inc. |

Mr. Kennard is Senior Advisor at Grain Management, a private equity firm, since October 2013. Prior to joining Grain Management, Mr. Kennard served as U.S. Ambassador to the European Union from 2009 to August 2013; Managing Director of The Carlyle Group from 2001 to 2009; and Chairman of the Federal Communications Commission from 1997 to 2001. |

E. Marie McKee

|

| Independent Director Nominee | | | | |

| | Age: 63

Director of Duke Energy or its predecessor companies since 1999

President, Corning Museum of Glass | | Skills and Qualifications: • Ms. McKee's qualifications for election include her experience in human resources, which provides her with a thorough knowledge of employment and compensation practices. Her experience as President of Steuben Glass has also given her excellent operating skills and understanding of financial matters. | | Committees: • Audit Committee • Compensation Committee • Corporate Governance Committee Other current public directorships: • None |

Ms. McKee is President of the Corning Museum of Glass since 1998, and she served as Senior Vice President of Human Resources at Corning Incorporated, a manufacturer of components for high-technology systems for consumer electronics, mobile emissions controls, telecommunications and life sciences, from 1996 to 2010. Ms. McKee has over 30 years of experience at Corning, where she held a variety of management positions with increasing levels of responsibility, including President of Steuben Glass. |

DUKE ENERGY – 2014 Proxy Statement 19

Back to Contents

PROPOSAL 1: ELECTION OF DIRECTORS

| | | | | | |

E. James Reinsch

|

| Independent Director Nominee | | | | |

| | Age: 70

Director of Duke Energy or its predecessor companies since 2009

Retired Senior Vice President and Partner,

Bechtel Group and past President, Bechtel Nuclear

| | Age 67Skills and Qualifications:•

Mr. Reinsch's qualifications for election include his management experience and extensive knowledge of the nuclear industry and construction business.

| | Committees: • Finance and Risk Management Committee • Nuclear Oversight Committee Other current public directorships: • None |

Mr. Reinsch was Senior Vice President and Partner of Bechtel Group from 2003 to 2008 and past president of Bechtel Nuclear from 2000 until his retirement in 2009. He has served on the boards of several international nuclear energy organizations, including the International Nuclear Energy Academy. He has also served on the U.S. Department of Energy's Hydrogen and Fuel Cell Technical Advisory Committee.

Mr. Reinsch's qualifications for election include his management experience and extensive knowledge of the nuclear industry and construction business. |

Table of Contents

| | |

| |

James T. Rhodes

|

| Independent Director Nominee | | | | |

| | Age: 72

Director of Duke Energy or its predecessor companies since 2001

Retired Chairman, President and Chief Executive Officer,

Institute of Nuclear Power Operations

| | Age 69

Dr. Rhodes was ChairmanSkills and CEO of the Institute of Nuclear Power Operations, a nonprofit corporation promoting safety, reliability and excellence in nuclear plant operation, from 1998 to 1999 and Chairman, President and CEO from 1999 until his retirement in 2001. He served as President and CEO of Virginia Electric & Power Company, a subsidiary of Dominion Resources, Inc., from 1989 until 1997. Dr. Rhodes is a former member of the Advisory Council for the Electric Power Research Institute.

Qualifications:• Dr. Rhodes' qualifications for election include his management experience as Chief Executive Officer of a large non-profit organization in the energy industry, as well as his in-depth knowledge of the energy and nuclear industry. | | Committees: • Nuclear Oversight Committee • Regulatory Policy and Operations Committee Other current public directorships: • None |

Dr. Rhodes was Chairman and Chief Executive Officer of the Institute of Nuclear Power Operations, a nonprofit corporation promoting safety, reliability and excellence in nuclear plant operation, from 1998 to 1999 and Chairman, President and Chief Executive Officer from 1999 until his retirement in 2001. He served as President and Chief Executive Officer of Virginia Electric & Power Company, a subsidiary of Dominion Resources, Inc., from 1989 until 1997. Dr. Rhodes is a former member of the Advisory Council for the Electric Power Research Institute. |

|

| Independent Director Nominee |

| | | |

James E. Rogers

| | Age: 65

Director of Duke Energy or its predecessor companies since 1988

Chairman, President and Chief Executive Officer

Duke Energy Corporation

Age 632001

Chairman, Regis HR Group, Concordia Healthcare Holdings, LLC | | Skills and Qualifications: • Mr. Rogers has served as President, CEO and a member of the Board of Directors of Duke Energy since its merger with Cinergy Corp. in 2006 and has served as Chairman since 2007. Mr. Rogers was Chairman and CEO of Cinergy Corp. from 1994 until its merger with Duke Energy. He was formerly Chairman, President and CEO of PSI Energy, Inc. from 1988 until 1994. Mr. Rogers is currently a director of Applied Materials, Inc. and CIGNA Corporation and a former director of Fifth Third Bancorp.

Mr. Rogers'Saladrigas' qualifications for election include his 22 years as Chief Executive Officer of a utility company, and hisextensive expertise in the energy industry, the affairs of the Companyhuman resources, financial services and its businesses. |

Table of Contents

| | |

| | Philip R. Sharp

Director of Duke Energy or its predecessor companies since 2007

President

Resources for the Future

Age 68

Dr. Sharp has served as President of Resources for the Future since 2005. He joined Duke Energy's Board of Directors in 2007, having previously served on the board of directors of one of its predecessor companies from 1995 to 2006. Dr. Sharp was a member of Congress from Indiana for 20 years, serving on the House Energy and Commerce Committee. He is a member of the Blue Ribbon Commission on America's Nuclear Future, and he currently serves as Congressional Chair of the non-profit National Commission on Energy Policy.

Dr. Sharp's qualifications for election include broad experience in government, including regulatory and legislative processes,accounting arenas, as well as his understanding of governmental relations,Duke Energy's Florida service territory. | | Committees: • Audit Committee • Compensation Committee • Regulatory Policy and Operations Committee Other current public policydirectorships: • Advance Auto Parts, Inc. |

Mr. Saladrigas is Chairman of Regis HR Group, which offers a full suite of outsourced human resources services to small and mid-sized businesses. He has served in this position since July 2008. Mr. Saladrigas also serves as Chairman of Concordia Healthcare Holdings, LLC, which specializes in managed behavioral health, since January 2011. He served as Vice Chairman, from 2007 to 2008, and Chairman, from 2002 to 2007, of Premier American Bank in Miami, Florida. Mr. Saladrigas served as Chief Executive Officer of ADP Total Source (previously the energy industry.Vincam Group, Inc.) from 1984 to 2002. |

The Board of Directors Recommends a Vote "FOR" Each NomineeTHE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH NOMINEE.

.

20 DUKE ENERGY – 2014 Proxy Statement

Table of Contents

INFORMATION ON THE BOARD OF DIRECTORS

Our Board Leadership

Our Board of Directors' Leadership Structure and Meeting Attendance

The BoardDirectors is currently combines the role ofstructured with an independent Chairman of the Board withand a separate Vice Chairman who is also our President and Chief Executive Officer. On January 1, 2014, Ann Gray, previously the Company's independent lead director, became Chairman of the Board. Our President and Chief Executive Officer, Lynn Good, assumed the role of Vice Chairman in July 2013.

The Board of Directors believes that the Company and its shareholders are best served by the Board retaining discretion to determine the appropriate leadership structure for the Company based on what it believes is best for the Company at a particular point in time, including whether the same individual should serve as both Chief Executive Officer. Combining theOfficer and Chairman and CEO roles fosters clear accountability, effective decision-making, and alignment on corporate strategy. To assure effective independent oversight,of the Board, has adopted a numberor whether the roles should be separate. In the event that the Board of governance practices, including havingDirectors determines that the same individual should hold the positions of Chief Executive Officer and Chairman of the Board, the Company's Principles for Corporate Governance provide for an independent lead director with the following responsibilities: (i) leading, in conjunction with the Corporate Governance Committee, the process for review of the Chief Executive Officer and Board, (ii) presiding at Board of Directors' meetings when the Chairman is not present, (iii) presiding at executive sessions of the non-management directors, (iv) assisting in the setting of the Board of Directors' meeting agendas with the Chairman, and (v) serving as a liaison betweento be appointed from among the independent directors and the Chairman and the Chief Executive Officer. Ms. Gray was appointed by the Board of Directors as lead independent director on April 4, 2006.directors.

Director Attendance

The Board of Directors of Duke Energy met 1110 times during 2010,2013 and has met 3 times so far in 2011. No2014. The overall attendance percentage for our directors was approximately 95% in 2013, and no director attended less than 75 percent75% of the total of the Board of Directors' meetings and the meetings of the committees upon which he or she served.served in 2013. Directors are encouraged to attend the annual meeting of shareholders.shareholder meeting. All members of the Board of Directors attended Duke Energy's last annual shareholder meeting of shareholders on May 6, 2010.2, 2013.

Risk Oversight

The Board of Directors is actively involved in the oversight of risks that could affect Duke Energy. This oversight is conducted primarily through the Finance and Risk Management Committee of the Board but also through the other committees of the Board, as appropriate. See below for descriptions of each of the committees. The Board and its committees, including the Finance and Risk Management Committee, satisfy thisits risk oversight responsibility through reports by each committee chair regarding the committee's considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within Duke Energy.

Independence of Directors

The Board of Directors may determine a director to be independent if the Board of Directors has affirmatively determined that the director has no material relationship with Duke Energy or its subsidiaries (references in this proxy statement to Duke Energy's subsidiaries shall mean its consolidated subsidiaries), either directly or as a shareholder, director, officer or employee of an organization that has a relationship with Duke Energy or its subsidiaries. Independence determinations are generally made on an annual basis at the time the Board of Directors approves director nominees for inclusion in the annual proxy statement and, if a director joins the Board of Directors in the interim, at such time.

The Board of Directors also considers its Standards for Assessing Director Independence, which set forth certain relationships between Duke Energy and directors and their immediate family members, or affiliated entities, that the Board of Directors, in its judgment, has deemed to be material or immaterial for purposes of assessing a director's independence. Duke Energy's Standards for Assessing Directors Independence are linked on our website at http://www.duke-energy.com/corporate-governance/board-of-directors/independence.asp. In the event a director has a relationship with Duke Energy that is not addressed in the Standards for Assessing Director Independence, the independent members of the Board of Directors determine whether such relationship is material.

The Board of Directors has determined that none of the directors, other than Mr. Rogers,Ms. Good, has a material relationship with Duke Energy or its subsidiaries, and all are, therefore, independent under the listing standards of the NYSE and the rules and regulations of the SEC. In arriving at this

Table of Contents

determination, the Board of Directors considered all transactions and the materiality of any relationship with Duke Energy and its subsidiaries in light of all facts and circumstances.